Mortgage-Free or Leveraged? Deciding the Best Strategy for Your Rental Property

Should you pay off your rental property or keep the mortgage? Learn the pros and cons of each approach to maximize your financial strategy.

View this post on Instagram

A post shared by Steve Welty | SD and OC Property Management Expert (@goodlifepropertymgmt)

One of the most common questions real estate investors wrestle with is whether to pay off a rental property early or keep the mortgage and invest elsewhere. There’s no one-size-fits-all answer—your decision depends on your financial situation, risk tolerance, and long-term goals.

If you’re wondering what’s best for your investment strategy, schedule a call with us at (858) 207-4595. At Good Life Property Management, we help landlords make informed decisions that align with their financial and real estate goals.

Key takeaways

- Low mortgage rates may favor investing elsewhere if your loan is under 4% and other assets offer higher returns.

- Paying off your property increases cash flow by eliminating mortgage payments and boosting rental income.

- Financial security matters as much as returns if being debt-free provides peace of mind.

- Leveraging debt can accelerate wealth growth by freeing up capital for additional investments.

- A hybrid approach offers balance by allowing you to invest while gradually paying down your mortgage.

Table of Contents

When Keeping Your Mortgage Makes Sense

From a strictly financial perspective, keeping your mortgage and investing elsewhere often leads to higher long-term returns.

1. Low Interest Rates vs. Higher Investment Returns

- If you locked in a mortgage rate below 4%, your money may work harder for you in other investments.

- The stock market has historically returned about 10% annually, and treasury rates may even exceed your mortgage rate.

- The difference between a 3% mortgage and a 10% market return means more growth over time if you keep your loan and invest.

2. Leveraging Your Money for More Growth

- Keeping a mortgage frees up capital for other opportunities, such as buying additional rental properties or investing in ETFs.

- Real estate investors often use leverage to expand their portfolios rather than tying up funds in a single asset.

If you’re considering expanding your real estate investments, check out The 5 Ways Real Estate Pays to learn how leverage can work in your favor.

3. Tax Benefits of a Mortgage

- Mortgage interest is tax-deductible, reducing your taxable income.

- Rental property depreciation further helps lower tax liabilities.

For a full breakdown of rental property tax deductions, check out Rental Property Deductions Checklist for Landlords in 2025.

Bottom Line: If your mortgage rate is low and you’re comfortable with some risk, keeping your loan and investing your money elsewhere could generate greater wealth over time.

When Paying Off Your Rental Property Is a Smart Move

While financial math often favors keeping a mortgage, personal peace of mind is just as important.

1. Debt-Free = Less Risk & More Freedom

- Eliminating mortgage payments reduces financial stress and increases cash flow.

- Without a mortgage, rental income becomes pure profit, strengthening long-term financial security.

2. Psychological Benefits & Stability

- Morgan Housel, in The Psychology of Money, argues that financial decisions are often emotional.

- If being debt-free helps you sleep better at night, that’s a valid and valuable reason to pay off your loan.

3. Retirement & Cash Flow Focus

- Many investors pay off rental properties as they near retirement, ensuring they have steady, mortgage-free income.

- Without a mortgage, monthly cash flow increases, making real estate a stable income source in retirement.

Bottom Line: If financial security, peace of mind, and reduced risk matter more to you than squeezing out extra returns, paying off your property may be the right move.

A Balanced Approach: Paying Off Some, Investing Some

You don’t have to go all-in on either strategy. A hybrid approach can give you the best of both worlds.

- Invest in the market while making extra payments on your mortgage.

- Pay off the mortgage gradually instead of making a lump sum payment.

- Reevaluate your priorities as interest rates, investment returns, and personal circumstances change.

We’re Here to Help You Make the Right Move

Deciding whether to pay off your rental property or keep the mortgage depends on your financial goals, risk tolerance, and personal preferences.

If you’re unsure which approach is best for you, schedule a call to speak with one of our Good Life experts. At Good Life Property Management, we help landlords maximize their investments while maintaining financial stability. We believe that life should be enjoyed, not spent sweating the small stuff. That’s why we set out on a mission to make property management easy. We care about you, your property, and your tenant. And we do it all, so you can Live the Good Life.

FAQs About Paying Off Rental Property vs. Keeping a Mortgage

Should I pay off my rental property if I have extra cash?

It depends. If your mortgage rate is low and you can earn higher returns elsewhere, keeping the mortgage may be better. But if you value financial freedom and peace of mind, paying it off could be a smart move.

What’s the biggest benefit of keeping a mortgage?

The ability to invest your capital elsewhere and earn a higher return than your mortgage interest rate. Leveraging debt lets you grow wealth faster over time.

Does paying off my rental property increase my cash flow?

Yes. Without a mortgage, 100% of your rental income becomes profit, significantly increasing cash flow. This is especially beneficial in retirement.

What if I want both security and investment growth?

Consider a hybrid strategy—pay extra toward your mortgage while also investing in higher-return assets like stocks, bonds, or another rental property.

Steve Welty

Subscribe to our Weekly Newsletter

Join the 5k+ homeowners receiving Local Law Updates and Landlord Tips. Delivered to your inbox every Saturday at 6am PST.

Share this:

Get in touch with us:

We make owning rental property easy.

Choose Your Next Step

Good Life Blogs

We believe that education is empowering.

Three Ideas That Changed My Life

These three ideas got me to think differently about the way I do business and the way I live my life.

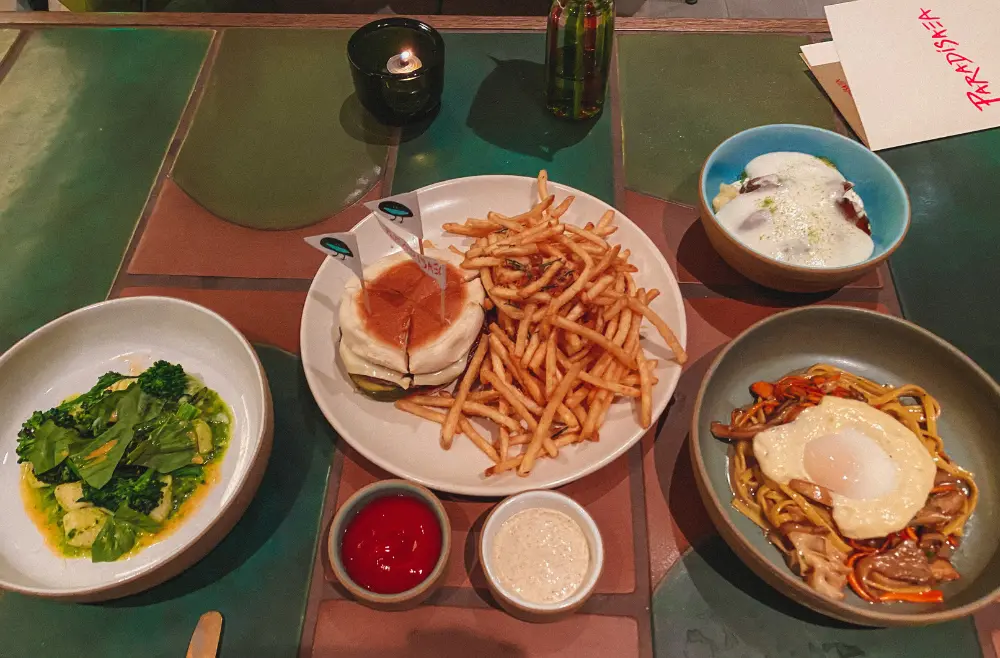

Best New Bars and Restaurants in San Diego

New bars and restaurants are constantly popping up around San Diego. These are the best of them all.

Houses vs. Condos: What Are the Pros & Cons?

Should you purchase a home or a condo? These pros and cons will help you decide which type of property is the best fit for you.